All Categories

Featured

Table of Contents

- – Which Course Should I Take To Become Proficien...

- – What Is The Most Comprehensive Course For Unde...

- – What Is The Most Practical Course For Investm...

- – What Are The Best Practices Learned In Profit...

- – Which Learning Resource Is Most Effective Fo...

- – How Much Does Wealth Creation Training Cost?

Any kind of continuing to be overage comes from the proprietor of record right away before completion of the redemption period to be asserted or designated according to regulation - financial education. These amounts are payable ninety days after execution of the action unless a judicial activity is set up during that time by an additional complaintant. If neither declared neither designated within 5 years of day of public auction tax sale, the excess shall escheat to the general fund of the governing body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, routed the Code Commissioner to alter all referrals to "Register of Mesne Conveyances" to "Register of Deeds" anywhere showing up in the 1976 Code of Regulations.

Which Course Should I Take To Become Proficient In Training Courses?

201, Component II, Section 49; 1993 Act No. 181, Area 231. The stipulations of Sections 12-49-1110 with 12-49-1290, comprehensive, connecting to discover to mortgagees of proposed tax obligation sales and of tax obligation sales of buildings covered by their particular home mortgages are embraced as a component of this chapter.

Official may void tax sales. If the official in fee of the tax sale finds prior to a tax title has passed that there is a failing of any action needed to be effectively carried out, the authorities may void the tax obligation sale and refund the amount paid, plus rate of interest in the quantity in fact earned by the county on the amount refunded, to the effective prospective buyer.

HISTORY: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Area 14; 2006 Act No. 386, Areas 35, 49. Code Commissioner's Note At the direction of the Code Commissioner, the very first sentence as modified by Area 49.

Contract with region for collection of tax obligations due community. An area and district may acquire for the collection of local taxes by the area.

What Is The Most Comprehensive Course For Understanding Wealth Strategy?

In addition, a lot of states have regulations influencing bids that go beyond the opening proposal. Settlements above the area's benchmark are known as tax obligation sale overages and can be lucrative financial investments. The details on overages can create troubles if you aren't aware of them.

In this write-up we inform you just how to obtain listings of tax excess and earn money on these assets. Tax obligation sale excess, likewise called excess funds or superior bids, are the amounts quote over the beginning price at a tax obligation auction. The term describes the dollars the capitalist spends when bidding process above the opening quote.

What Is The Most Practical Course For Investment Blueprint Education?

The $40,000 increase over the initial quote is the tax obligation sale overage. Declaring tax sale excess implies acquiring the excess cash paid during an auction.

That claimed, tax sale overage cases have shared qualities across most states. Generally, the region holds the cash for a specific duration depending upon the state. Throughout this period, previous owners and home loan owners can contact the region and receive the overage. Nonetheless, regions usually don't find previous owners for this purpose.

What Are The Best Practices Learned In Profit Maximization Courses?

If the period ends before any type of interested events assert the tax sale overage, the region or state usually takes in the funds. Past owners are on a rigorous timeline to insurance claim excess on their residential or commercial properties.

Keep in mind, your state legislations affect tax sale overages, so your state might not enable capitalists to accumulate overage interest, such as Colorado. In states like Texas and Georgia, you'll make passion on your entire bid. While this element doesn't mean you can assert the overage, it does help alleviate your costs when you bid high.

Bear in mind, it could not be lawful in your state, suggesting you're restricted to gathering rate of interest on the excess - real estate claims. As specified over, a financier can locate means to make money from tax obligation sale overages. Since passion income can use to your entire bid and previous owners can claim overages, you can take advantage of your expertise and tools in these circumstances to make the most of returns

Initially, as with any kind of investment, research is the essential opening action. Your due diligence will certainly give the required understanding right into the properties readily available at the following public auction. Whether you make use of Tax obligation Sale Resources for financial investment information or call your area for info, an extensive examination of each home allows you see which residential or commercial properties fit your investment version. A crucial facet to bear in mind with tax sale overages is that in the majority of states, you just require to pay the region 20% of your complete bid up front. Some states, such as Maryland, have regulations that surpass this rule, so once more, research your state laws. That stated, a lot of states comply with the 20% rule.

Which Learning Resource Is Most Effective For Training Program?

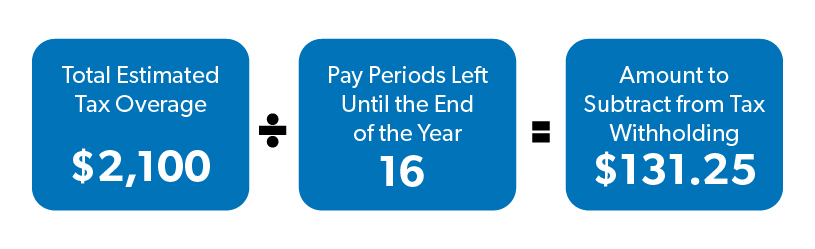

Rather, you only need 20% of the quote. Nonetheless, if the residential property does not retrieve at the end of the redemption duration, you'll require the continuing to be 80% to obtain the tax obligation act. Since you pay 20% of your bid, you can gain passion on an excess without paying the complete rate.

Again, if it's legal in your state and county, you can function with them to help them recuperate overage funds for an extra charge. You can accumulate interest on an overage bid and charge a fee to simplify the overage claim process for the previous proprietor.

Overage collection agencies can filter by state, region, building kind, minimum overage quantity, and maximum overage quantity. When the data has been filteringed system the enthusiasts can make a decision if they intend to include the avoid mapped data package to their leads, and after that spend for just the verified leads that were discovered.

How Much Does Wealth Creation Training Cost?

In enhancement, simply like any type of other financial investment method, it supplies one-of-a-kind pros and disadvantages. financial guide.

Table of Contents

- – Which Course Should I Take To Become Proficien...

- – What Is The Most Comprehensive Course For Unde...

- – What Is The Most Practical Course For Investm...

- – What Are The Best Practices Learned In Profit...

- – Which Learning Resource Is Most Effective Fo...

- – How Much Does Wealth Creation Training Cost?

Latest Posts

Free Tax Liens List

Tax Lien Investing Ny

Real Estate Investing Tax Lien Certificates

More

Latest Posts

Free Tax Liens List

Tax Lien Investing Ny

Real Estate Investing Tax Lien Certificates